Get Your First Chapters with Worksheets For Free

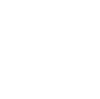

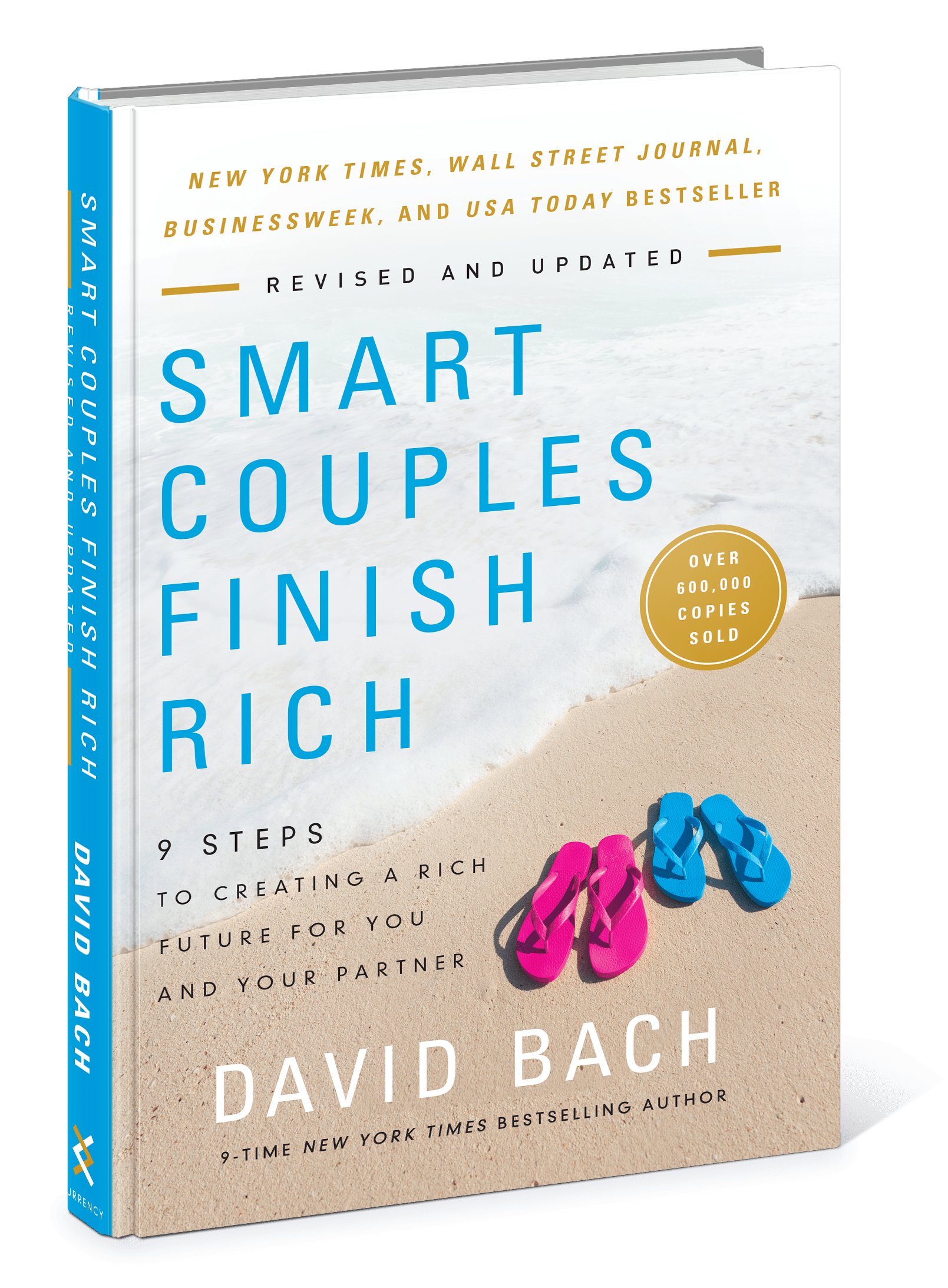

SMART WOMEN FINISH RICH

8 steps to achieving financial security and funding your dreams

Want my favorite tips for both life and money?

Join my free 3 Minute Sunday newsletter.

Meet David

David Bach is one of America’s most trusted financial experts and bestselling financial authors of our time. He has written ten consecutive New York Times bestsellers with more than seven million books in print, translated in over 19 languages.

His runaway #1 bestseller The Automatic Millionaire spent 31 weeks on the New York Times bestseller list. He is one of the only business authors in history to have four books simultaneously on the Wall Street Journal, BusinessWeek and USA Today bestseller lists.

Over the past 20 years David has touched tens of millions through his seminars, speeches and thousands of media appearances. He has been a contributor to NBC’s Today Show appearing more than 100 times, and a regular on The Oprah Winfrey Show, ABC, CBS, Fox, CNBC, CNN, Yahoo, The View, PBS, and many more.

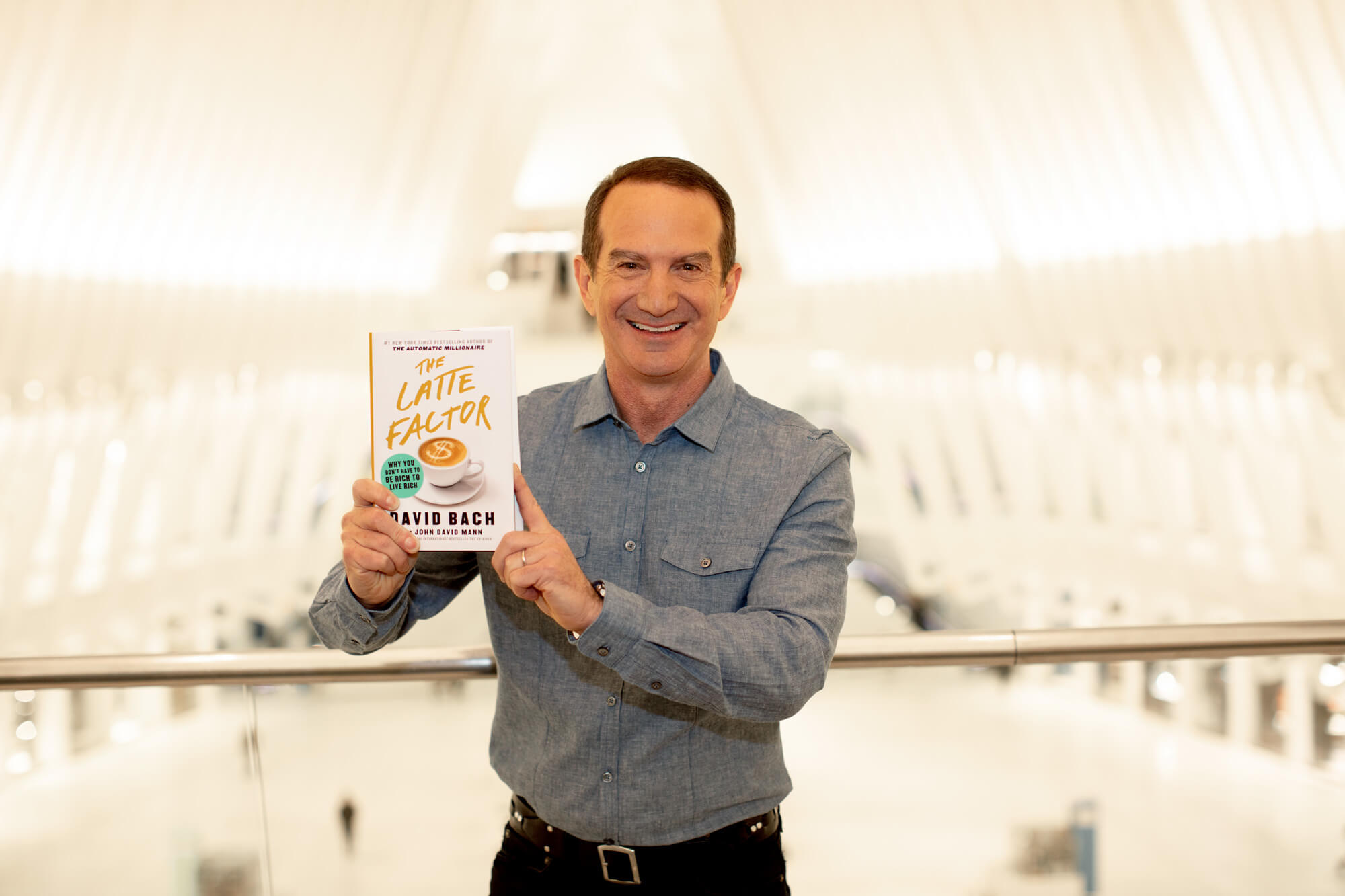

The Latte Factor Class – all new!

Presenting:

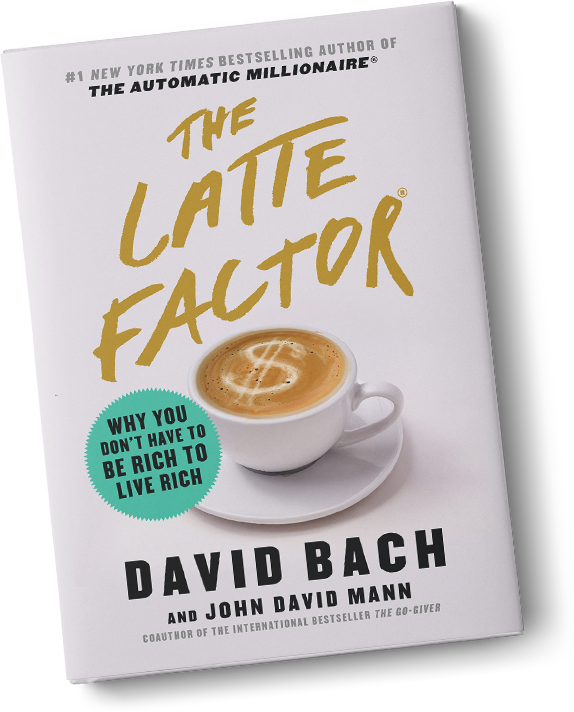

The Latte Factor®

Achieve Financial Freedom and Live Your Dream Now

What if you didn’t need to be rich to live rich? What if there were a way you could achieve financial freedom and live your dreams now.

In less than five hours – The Latte Factor Class can help you take control over your money and your life. Whether you’re just starting out in business, an employee, or you’re in debt and you just want to live the life you’ve always dreamed of “The Latte Factor” is a one day program that has inspired millions.

It’s never too late to start living your dreams. Whether you are living paycheck to paycheck, or simply want to do better financially this class is for you if you’re ready for a fresh outlook on life and money.

From The Blog

Bach Wisdom—16 Timeless Truths

Take these 16 truths everywhere you go!

1. Always spend less than you make – your life will be much easier and less stressful.

1. Always spend less than you make – your life will be much easier and less stressful.

2. Pay yourself first – at least an hour a day of your income – you’re going to work 90,000 hours over your lifetime you should keep at least an hour a day of your income.

David Bach – The Latte Factor® – Why I Wrote This Book Now

Entering the working world is particularly harsh nowadays, and twenty-somethings trying to juggle their student loan debt, possible credit card debt, and low wages understandably feel discouraged and exhausted. While debt can become isolating, it's important to remember that you're not alone, and The Latte Factor (available May 7), by best-selling author David Bach is the perfect companion for those struggling to make ends meet.

We had the honor of chatting with author David Bach about The Latte Factor, and he offered some additional financial wisdom for people young and old trying to manage their money. Wise Bread: David, THE LATTE FACTOR, Why You Don’t Have To Be Rich To Live Rich is your 13th book.

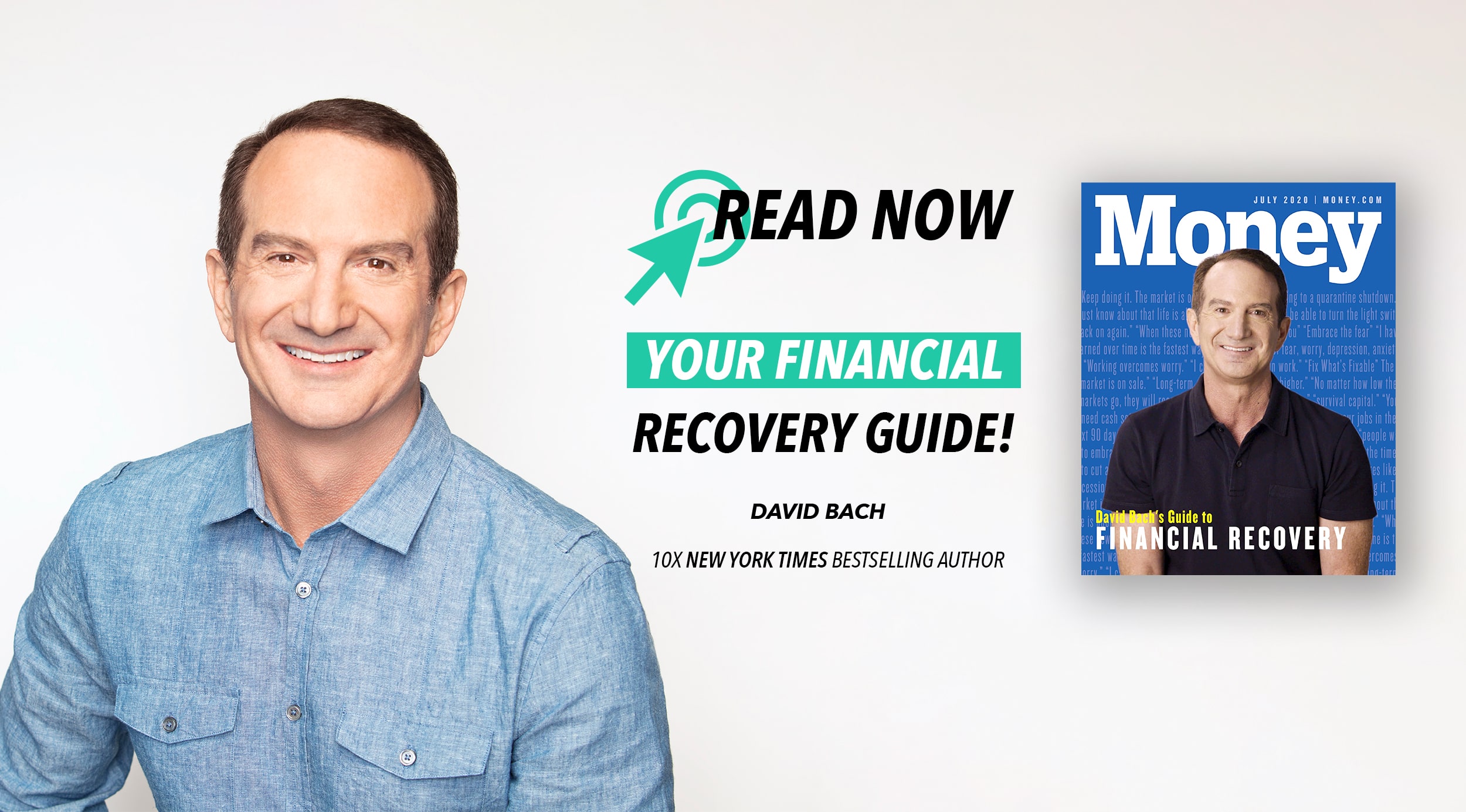

David Bach’s Guide to Financial Recovery

“You’re not supposed to leave your home,” Bach told listeners who hadn’t yet experienced quarantine against the new coronavirus. “Everything is closed. What’s happening in Italy is probably coming your way.”

Want my favorite tips for both life and money?

Join my free 3 Minute Sunday newsletter.

Get Your First Chapters with Worksheets For Free

SMART WOMEN FINISH RICH

8 steps to achieving financial security and funding your dreams

I am raw html block.

Click edit button to change this html